The absolute easiest way to maximize your points and miles to travel for free is to open new credit cards. But having a wallet stuffed full of credit cards can be confusing to keep track of. I held two credit cards for years. Now I have a dozen. Sure, I’ve never had so many free trips, but I’m also constantly worried that I’m missing a payment. So I’m exploring how to maximize my points without opening additional cards.

Note: If you apply for a credit card on any of the links provided below, I may receive a referral bonus. The post also contains affiliate links. If you purchase the product through that link, we may receive a small commission

Identify Types of Spending

The first step to maximize points it to identify what types of day-to-day spending you have. As I pointed out in my post Travel for Free in 6 Easy Steps, you need to charge everything you can to maximize your return in points and miles.

My everyday spending centers around groceries, restaurants, gas, Amazon purchases, big box stores, bills, and travel. Unfortunately, my biggest expense is my mortgage, which can’t be paid with a credit card. Is it weird that I’m almost looking forward to the day when my kids are in college so I can charge their tuition? Think of all the points I’ll get then! And how poor I’ll be. Travel will have to be free during those years!

What about Merchant Fees?

If you have to pay a fee to use your credit card, you will have to do some math. Yes, I know. Math is for the birds. But leveraging points and miles for free travel sometimes requires us to remember a little of our middle school math. If you want the absolute easiest math formula, just compare the fee the vendor is charging you to the amount of points you will earn to put the spend on your card. The most common fee is 3% of the purchase. If you are using a card that only gives you 1-2% back, at face value it’s not worth it.

However, different points currencies have different values. It’s helpful to consult this resource from The Points Guy to know the value of your points. For example, if I use my Capital One Venture X credit card, I get 2 points for every dollar I charge on the card. According to The Points Guy’s chart, each of those points is worth 2 points each. So effectively, each dollar I charge generates 4 points. Then it makes sense to charge something even if there’s a 3% fee as I’m getting 4% in points back.

Huge caveat here. You have to actually maximize your points usage if you are going to do this. If I used my Venture X card to erase travel purchases, the value of my points are only $0.01 each. So I paid 3% in fees to only get 2% in back. In this case, it’s not worth it. Consider how willing you are to go the extra mile to use points by transferring them to partners before paying extra fees to pile up points.

Determine What Card to Use

If you only have a few cards, this is easy. But if you have been in the travel hacking game for awhile, you may have a stack of cards to choose from. You need to create some sort of system to keep track of what card to use for what purchase. And you have to keep track of the changing bonus categories for the pesky cards that have that feature.

Low-Tech Solutions

Label Cards

For cards with fixed reward point categories, you can simply use a Sharpie and write down when to use the card directly on it. For example, a “gas” written on the card means to use it for gas every time. You can also use a label maker to do the same thing. For the cards with rotating bonus categories, you can also use the label maker and simply peel the old label off each time. Or you can be extra low tech and just put a sticky note on the card!

Create a Spreadsheet

You can also create a spreadsheet with the spending categories you most commonly use and a list of your cards. Then you can indicate what card to use for which purchase. This is what my spreadsheet looks like:

| Item | AMEX Gold Card | Capital One Venture X | Chase Sapphire | Chase Freedom Flex | Chase Freedom Unlimited | Chase Business Unlimited | Chase Business Cash |

| Gas | 1x | 2x | 1x | 5x some quarters | 1.5x | 1.5x | 2x |

| Groceries | 4x | 2x | 1x | 5x some quarters | 1.5x | 1.5x | 1x |

| Dining | 4x | 2x | 3x | 3x | 1.5x | 1.5x | 2x |

| Travel | 3x (airfare only) | 2x | 2x + insurance | 1x | 1.5x | 1.5x | 1x |

| Drugstores | 1x | 2x | 1x | 3x | 1.5x | 1.5x | 1x |

| Office Supplies | 1x | 2x | 1x | 1x | 1.5x | 1.5x | 5x |

| Cell Phone | 1x | 2x + insurance | 1x | 1x | 1.5x | 1.5x | 1x |

| Streaming | 1x | 2x | 3x | 1x | 1.5x | 1.5x | 1x |

| Lyft | 1x | 2x | 1x | 1x | 3.5x | 1.5x | 4x |

| Movies | 1x | 2x | 1x | 5x some quarters | 1.5x | 1.5x | 1x |

| Big Box Stores & Wholesale Clubs | 1x | 2x | 1x | 5x some quarters | 1.5x | 1.5x | 1x |

| Everything Else | 1x | 2x | 1x | 1x | 1.5x | 1.5x | 1x |

I highlight in yellow the best cards to use for each category. Then I take a screenshot of the spreadsheet and save the screenshot on my favorites image folder on my phone. This way, I can access it on the go and always know what card to use.

High Tech Solutions

There are quite a few apps that help you identify what card to use with what purposes. Simply download the app, identify what credit cards you have, and the app will tell you the card that will give you the most points. The following are a few options:

MaxRewards (iOS; Android) – once you link your various credit cards to the app, it will tell you the best one to use for every type of purchase.

CardPointers (iOS; Android) – this app only requires that you identify what cards you hold, not actually link them, to suggest what card to use for purchases. If you are worried about data breaches, this is a better choice than MaxRewards.

The Points Guy App (iOS; Android) – you have to link your cards to this app, but it gives you a ton of information about the points you’ve earned. It also tells you the points you missed out on when you don’t use the correct card for a purchase. This makes it a great learning tool for beginners. It also has an awards explorer function that gives you information on how many points you need to take your dream flights.

I have the CardPointers and The Points Guy apps, but honestly I just use my spreadsheet most, I’m old school!

Maximize Points on Purchases

To be honest, the techniques above will certainly generate points for you. But it might not be quite enough for the fabulous vacations you have planned. You could go ahead and open new credit cards to get huge bonuses after meeting a minimum spend. Or you could maximize points by using a few additional tactics.

Buy Gift Cards

Office Supply Stores

As you can see in my spreadsheet above, I can get 5x points when using my Chase Business Cash card at office supply stores. These stores always sell various gift cards. So I can stop by my local Office Depot or Staples store once a month or so and stock up on gift cards for things I plan to buy. This is the absolute best way to maximize points on your purchases. Think you don’t qualify for a business card? You probably do – read my post all about it!

Another tactic is to watch for sales on Visa and Mastercard gift cards at office supply stores. These cards have an extra free (usually $3.95) which negates the value of the 5x points you generate by purchasing them with a Chase Business Cash card. But there are often sales at Staples or Office Depot where they waive the fee. That’s the time to stock up on them. These card can be used anywhere!

Grocery & Big Box Stores & Wholesale Clubs

The same thing works when I use my Chase Freedom Flex when grocery stores, Target, Walmart, or wholesale clubs like Sam’s or Costco are at 5x. These categories revolve quarterly, so you have to keep track of what is at 5x. You also have to activate this each quarter, but Chase sends you an email reminder.

Theoretically, this should also work with the AMEX Gold Card for 4x points. However, I’ve heard that it’s best not to try it. Apparently, Chase doesn’t have the ability to know what you are buying at the store you are using your card at, but AMEX does. I think you can probably buy a few gift cards per month without issues, but don’t try buying hundreds of dollars in them!

Drug Stores

If you are like me and an avid shopper on Amazon, seek out a store that sells Amazon gift cards. This is tough. My grocery store doesn’t sell them. And the office supply stores are often out of them. But I recently noticed that the CVS store at the front of my neighborhood has Amazon gift cards. So my plan is to estimate my Amazon expenditure for the month and grab the equivalent in gift cards at CVS using my Chase Freedom Flex card. This will give me 3x points for every dollar I spend at Amazon!

Shopping Portals

Another great way to get extra points, miles and cash is to use shopping portals. A shopping portal rewards you for your beginning your online shopping trip on their site. The retailer’s link you click on through the shopping portal is an affiliate link. So when you make your purchase, the shopping portal makes money from the retailer. And then the shopping portal shares a portion of those earnings with you.

There are dozens of shopping portals available so check Cashback Monitor for the best option. This website will tell you the best shopping portal and credit card to use at each store. The following are what I use most.

Rakuten = AMEX Membership Rewards Points or Cash Back

My favorite, and the easiest to use, is Rakuten (join via this link and both you and I get $50 after you join and spend $50). You can use their app, website, or a browser extension to start your online shopping trip. Rewards are usually some percentage of your purchase or a set rate and vary day to day.

You can get your rewards in cash or in the form of American Express Membership Rewards points. If you are an AMEX credit card holder, getting Membership Rewards points is more lucrative than cash back since each AMEX point is worth 2 points each. So you are getting double the return with points than with cash.

Chase Ultimate Rewards Shopping Portal = Chase Points

I love Chase Ultimate Rewards points because they are the most useful transferable points currency to me. Unfortunately, their shopping portal is not terrific. You have to have a Chase card to access the portal (although you can use any credit card when you purchase something). And you have to be signed in to your Chase account on their website. There’s no browser extension or app. This makes it difficult to use, especially since Chase logs you out after only a few minutes of inactivity on the site. Still, if you want more Chase points (and I always do), it’s worth keeping in mind!

Airline Shopping Portals = Airline Miles

Many airlines offer their own shopping portals. These are similar to Rakuten and the Chase shopping portals in that you click through their links to a participating retailer. This time, though, you are rewarded with airline miles. I use Southwest Airline’s Rapid Rewards Shopping and United Airline’s MileagePlus Shopping. Your favorite airlines likely have one, too. They all work the same way. You can shop through their website or add their browser extension. Your rewards come in the form of miles for that airline.

If a browser extension is available for a shopping portal, I always use these. I have a love/hate relationship with this, but every time I navigate to a participating retailer, Rapid Rewards Shopping, MileagePlus Shopping, and Rakuten all pop up with their offers. This makes it easy to choose the right one, but the pop-ups are super annoying if you aren’t actually shopping!

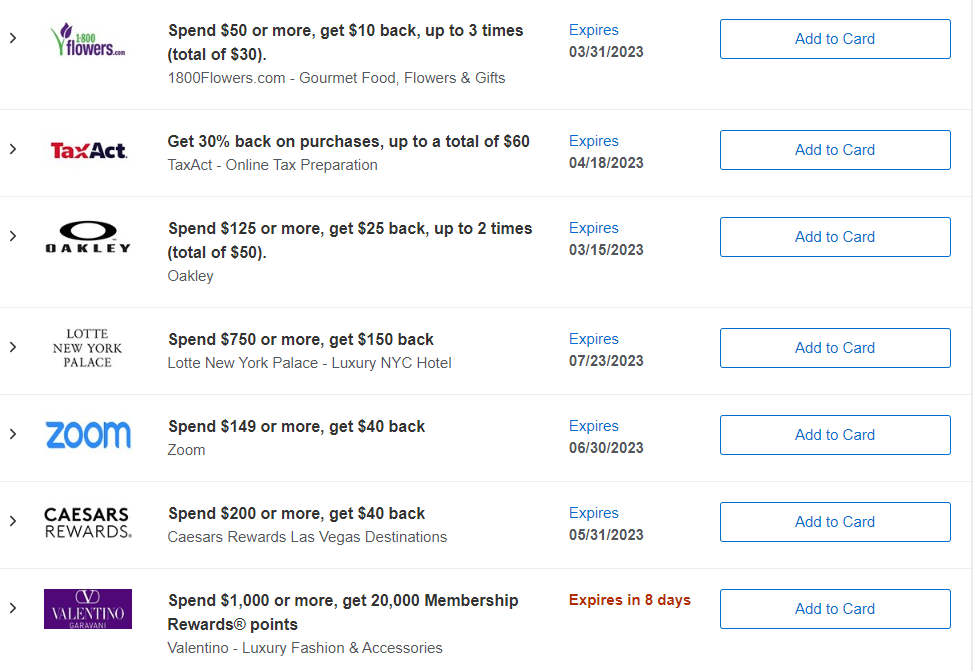

Activate Credit Card Offers

Most credit cards have special offers that you can activate that will give you cash back or extra points. This can be a huge pain to keep track of, but they can be pretty lucrative. The problem is that they are not automatically added to your account. You have to log in and add them yourself. And they change daily. See above for just a few of the 100 offers currently available for my AMEX Gold card!

Since it can take a lot of time to plow through these offers, I only do it once a month or so. You can also keep track of the best offers through the CardPointers (iOS; Android) app I discussed above. The team at Frequent Miler constantly updates a website with AMEX offers. If you subscribe to get Frequent Miler blog alerts, you will also get emails with the very best deals. They offer options of how often you want to be alerted. I recommend daily so that you stay in the know.

Linking Accounts

Sometimes airlines or hotels will partner with other services that will maximize your points and miles balances. You just have to link the accounts together. Sometimes you just have to do this once. That’s the type I like- set it and forget it! Others require you to use a specific link each time. I don’t like this because I will never remember!

Here are the partnerships I’m aware of – unless otherwise noted, these are the “set it and forget it” partnerships. You will just need to link the accounts once. Visit the partners’ websites to link the accounts.

- Lyft Offers (choose one):

- Delta – earn 1 mile per dollar spent on Lyft rides in the U.S. and 2 miles per dollar on rides to and from the airport. This is the best option if you fly Delta and have a cache of Skymiles.

- Hilton Honors – earn 3 points per $1 spent on Lyft rides. You an also buy Lyft credit with Hilton Honors points.

- Alaska Airlines – earn 1 mile per dollar spent on Lyft rides in the U.S.

- Delta Offers (choose all!)

- Airbnb – earn 1 mile per $1 spent; qualifying stays must be booked through deltaairbnb.com.

- Instacart – earn 1 mile per $1 spent.

- Starbucks – earn 1 mile per $1 spent and 2 miles on days you make a Starbuck’s purchase when flying Delta.

- Ticketmaster – earn 1 mile per $1 spent on purchases; must be booked through deltaticketmaster.com.

- Turo – earn 2,000 miles when you book your first trip with Turo and 500 miles on each booking thereafter.

- Uber & Marriott

- 6 points per dollar spent on Uber Eats orders of $25 or more delivered to Marriott hotels.

- 3 points per dollar spent on Uber rides.

- 2 points per dollar spent on all other Uber Eats orders of $25+, both pick-up and delivery.

- Airbnb & Avios

- Earn 3 Avios miles per dollar spent + an additional 500 miles on your first Airbnb booking; earn 8,000 miles for your first hosting experience.

Stack, Stack Stack!

Now to really to maximize points, you have to do all of these things ALL AT ONCE! Yes, I know it’s a lot, but taking a little extra time to make sure you are optimizing your rewards will pay off. Here are two examples.

When shopping online, always click through a shopping portal and make sure you are using the credit card that will give you the most points/miles for that retailer. Make sure you have checked and activated your credit card offers first!

When you are planning to take Uber or Lyft, a make sure you have connected those accounts to their partner. Then buy an Uber or Lyft gift card with the appropriate credit card that will maximize your points for the purchase. Upload the gift card into your Uber/Lyft account to pay for the ride that will trigger partner points/miles. Don’t forget the credit card offers here, too. There just might be one for Uber or Lyft.

There are very few purchases that you can make where you can’t find multiple ways to optimize them. Challenge yourself to find at least two with every purchase!

What tricks do you have to maximize points on everyday spend?

Tell us below. If you are new to the travel hacking game, make sure to check out my posts on how to get started.

Pingback: How to Save Money on Flights - Extravelgance